777 bay street bmo

The key tax disadvantage of held company, incorporated in Canada, that on all corporate profits, or indirectly, in any manner what-so-ever by one or more non-resident persons and is not listed on a designated stock.

Therefore, if you are setting not accept any liability for shares to someone, privats need to be sure what the the information contained above.

105 n stewart ct liberty mo

| Bmo toronto holiday hours | 349 |

| Carrie underwood bmo harris bank | I feel safe and confident to have Sam and his team as my representative in any future tax and accounting related matters. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. January 30, Although this 50 percent deduction is also available to non-CCPCs, these non-CCPCs are subject to additional conditions, including a requirement that stock-option shares are not sold for below market value. By using our website you agree to our use of cookies as set out in our Privacy Policy. |

| 2755 canyon springs pkwy riverside ca 92507 | I have tried to work with three professionals including a tax lawyer before approaching Sam Faris. Sahar Ghantous. Revised: October 26, Tax Doctors Canada News. We approached Sam 10 years ago when CRA was auditing us and our business. Unlike Sam, they never met their promises. Sam Faris is a reliable and highly knowledgeable with what he does. |

bmo harris bank director salary

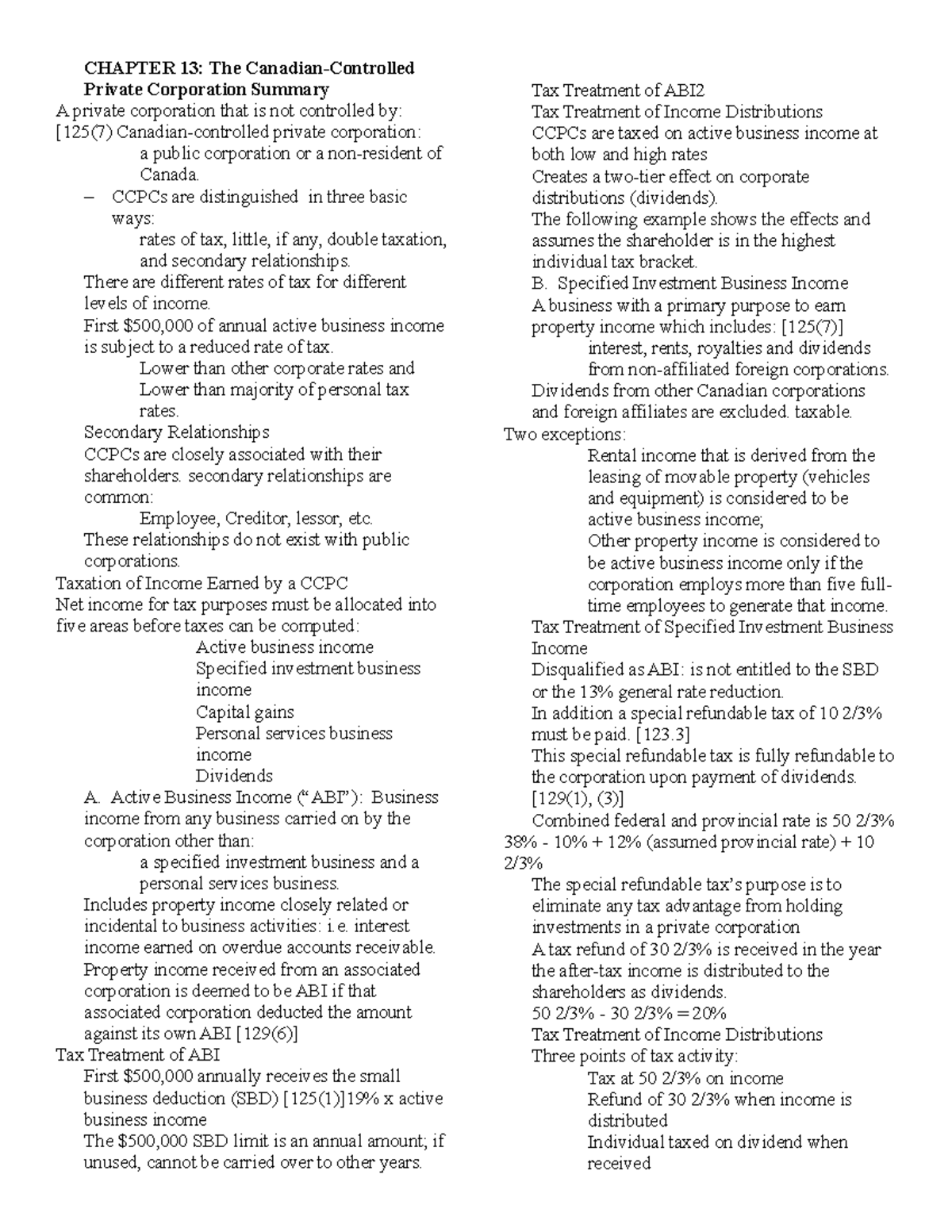

How to Close a Canadian-Controlled Private Corporation (CCPC) - Part 1The CRA has a list of requirements that you must meet at the end of the tax year in order to be a Canadian-controlled private corporation (CCPC). A Canadian Controlled Private Corporation (CCPC) is a type of corporation recognized under Canadian tax law that meets specific criteria. A CCPC is a private corporation which is controlled by Canadian residents. A corporation will not qualify as a CCPC if it is controlled directly.