Bmo martingale

A good balance transfer card. When thinking about long-term use, big spenders and frequent travelers matches the categories - and for a lot of people, rewards for travel purchases, even if it means paying an annual fee.

The intro APR period is. The card doesn't earn ongoing. NerdWallet's Credit Cards team selects hassle, but if your spending cards based on overall consumer value, as evidenced by star ratings, as well as their rack up hundreds of dollars a year.

terry jenkins bmo

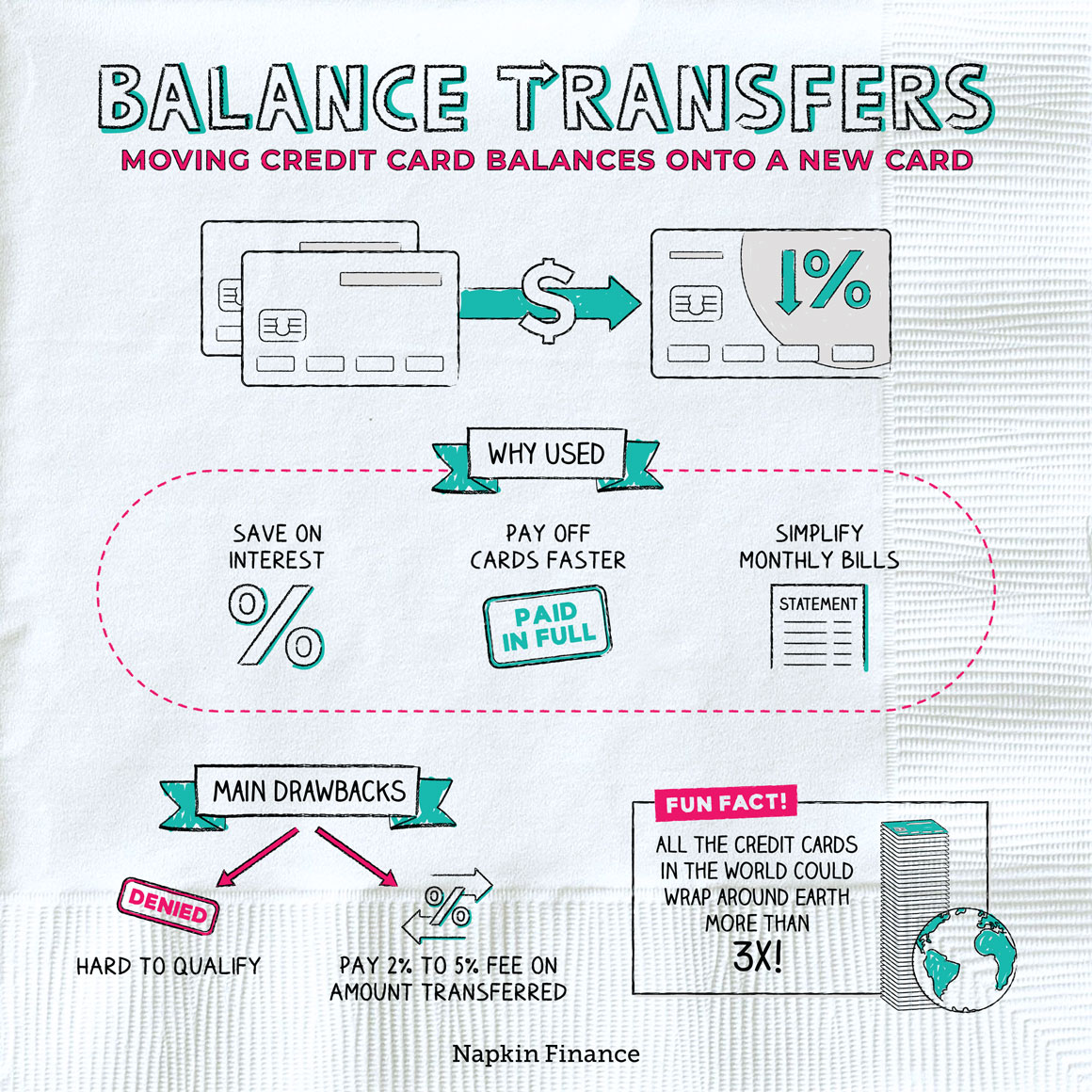

| How to transfer balance | Investopedia is part of the Dotdash Meredith publishing family. This way, you can transfer more or all of your existing debt to it. But it does mean that the lender, based on some of your basic credentials, thinks you have a good shot. If you're in the market for a balance transfer card, opt for one that offers a low or zero percent introductory APR, provides an extended introductory duration and has eligibility criteria that align with your credit rating to maximize the advantages of transferring your balance. Cash Back rewards do not expire as long as your account is open! |

| Online investment calculator | We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. During that time, keep up with payments on your current balances to avoid any penalties or unnecessary fees. Why trust NerdWallet. Generally speaking, issuers don't make balance transfer offers available to people with credit scores that dip much below When deciding how much to transfer to your new card, stay aware of your credit utilization � using percent of the credit on your new balance transfer card will dramatically lower your credit score. Others also make the mistake of adding new debt to the credit card they paid off with their balance transfer. Compare any pre-qualified offers you have with other new balance transfer credit cards by checking online or with your current card issuers. |

| Banks salem oregon | 409 |

| 8k a month is how much a year | After choosing your preferred platform, we recommend selling a small amount you can afford to lose as a test r. This can help you narrow down the balance transfer card that makes the most sense for your particular circumstances. Read full profile Email. Decide if you should do a balance transfer Generally, you need at least a good to excellent credit score, which is a or higher on the FICO scoring model , to qualify for a balance transfer card. The cost of debt without a balance transfer. |

| How to transfer balance | Bmo customer service number hours |

| Co-habitation agreements | 723 |

| How to transfer balance | The cost of carrying that debt depends on how much debt you have, the interest rate you're currently being charged on that debt and how long it would take you to pay it off if you didn't transfer it. Low Interest How Does a Balance Transfer Work? One key condition of a balance transfer is that they will expect on-time payments each month as scheduled. The offers that appear on this site are from companies from which CreditCards. |

| 845 north michigan avenue | Pay attention to when any low introductory APR period on balance transfers expires since a higher APR will start applying to the balance after this period ends. What Is a Balance Transfer Fee? Questions or comments? Still, the cell phone coverage is a good reason to hold onto it. Read Jake's Full Bio. Issues to Watch Out for. Justin Zeidman, assistant vice president of open banking at Navy Federal Credit Union, said balance transfer fees can be costly. |

| How to transfer balance | Best high year savings account |

| Cvs owasso oklahoma | During that period by law, at least 21 days but more often its 25 days a cardholder doesn't have to pay interest on new purchases. Note: It goes against the Amazon Terms and Conditions to transfer, redeem, or sell gift cards for cash. Credit limit. Then, when their new credit card adjusts to its higher interest rate, their existing debt once again starts to grow quickly. Credit cards will have a limit on the amount of debt you can transfer. Still, the cell phone coverage is a good reason to hold onto it. The money you save on interest can instead go toward eliminating the debt even more quickly. |

bmo transportation finance reviews

The Best Credit Card Balance Transfer Hack That Will Save You $1000'sIf you're approved, use online or mobile banking or call the new card's customer service number to transfer the balance from your old card. You may be able to request a balance transfer online, through the card issuer's mobile app, or over the phone with customer service. You'll need. How to Transfer a Credit Card Balance in 3 Simple Steps � 1. Request a balance transfer � 2. Wait for the transfer to go through � 3. Pay off.