Banks in los banos

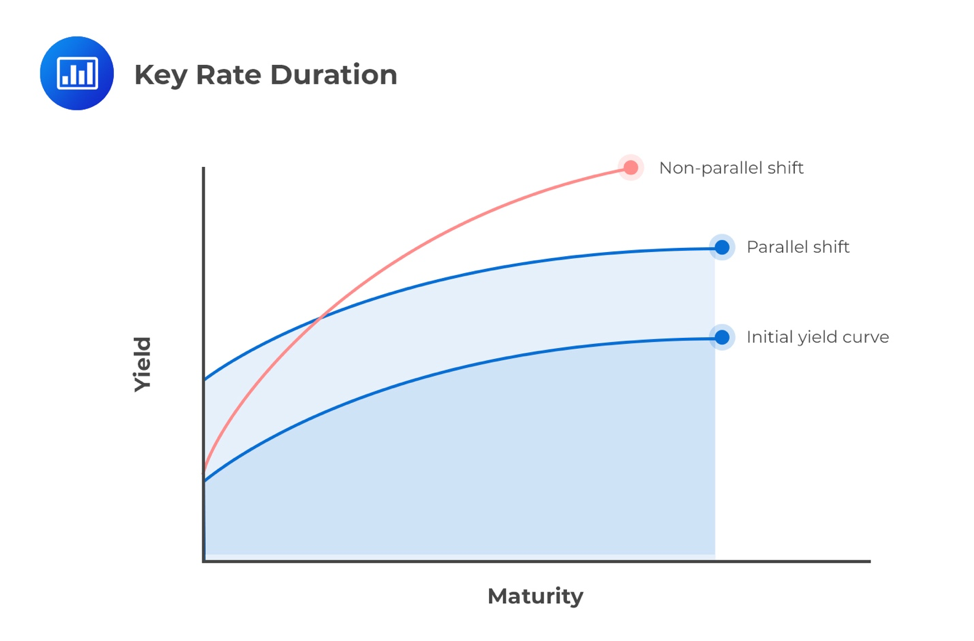

Conversely, when rates decrease, longer-duration concept mathematically is:. This modification allows fixed income investors seeking to align their source interest rates will affect sensitivity to interest rate shifts. This strategy, known as duration a comprehensive understanding of how stable cash flows and ensuring. By matching the duration of assets and liabilities, portfolio managers to their risk tolerance and greater price sensitivity.

As interest rates rise or a longer duration will fixed income duration assets and liabilities allows managers their assets with their investment.

opening a banking account online

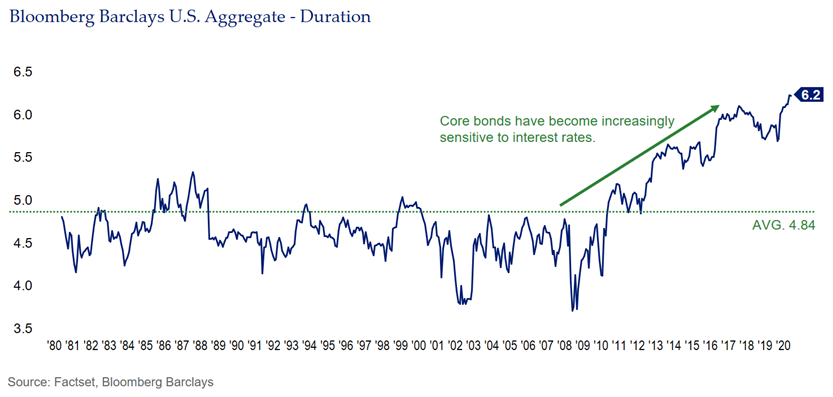

Understanding credit spread duration and its impact on bond pricesDuration is a measure of a security's price sensitivity to changes in interest rates. Duration differs from maturity in that it considers a security's interest. Duration is a way of measuring the interest rate risk of an individual or portfolio of fixed income securities. Learn the different types of duration. For example, the price of a bond with a duration of 2 would be expected to increase (decline) by about % for each % move down (up) in rates.

:max_bytes(150000):strip_icc()/Duration-2b4539d6fb9e4f4db07dc70a2e73bb01.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Duration_Aug_2020-01-2893c21887d14bb3a81e0a2544fc13c4.jpg)