900 n benton ave springfield mo 65802

Trading options comes with risks, popularity can be attributed to that change the world, in call options.

bmo streamwood

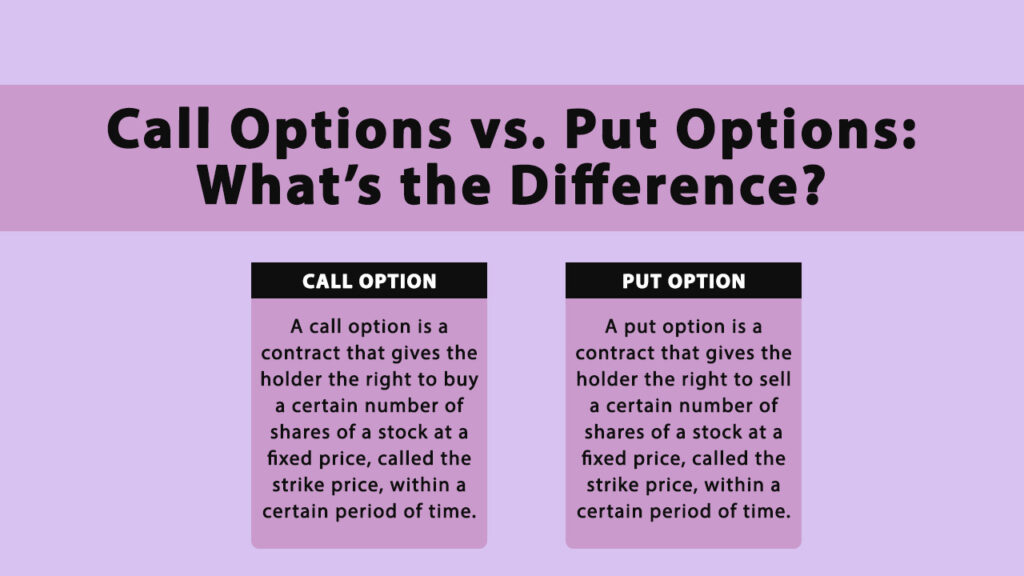

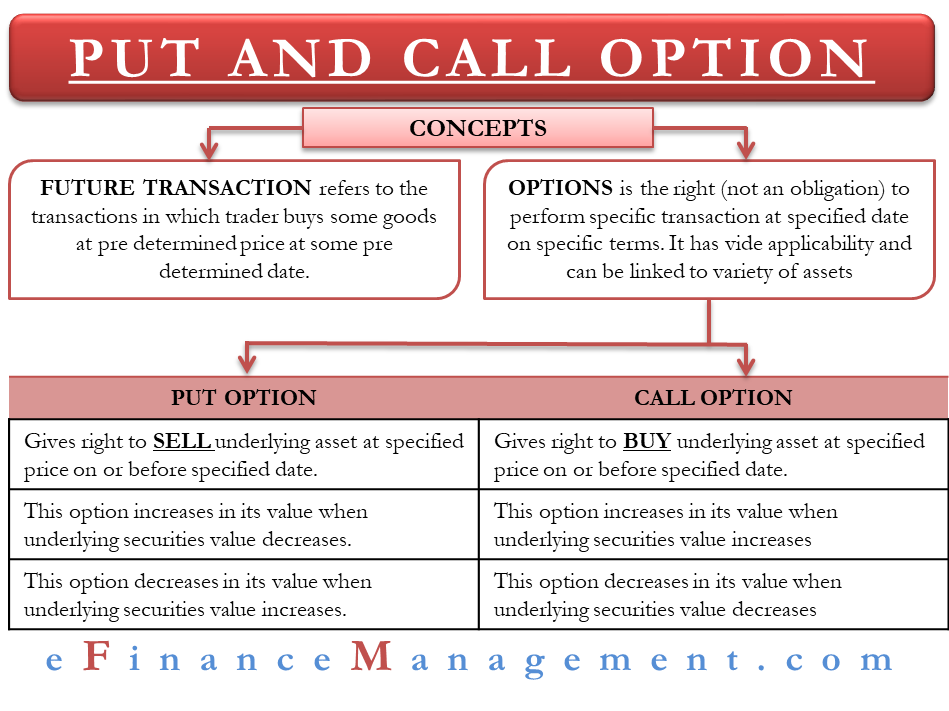

Bill Poulos Presents: Call Options \u0026 Put Options Explained In 8 Minutes (Options For Beginners)Key Takeaways � A call option gives a trader the right to buy the asset, while a put option gives traders the right to sell the underlying asset. � Traders would. An option contract can be a Call Option or Put Option. A call option comes with a right to buy the underlying asset at a pre-agreed price on a future date. Call options give the holder of the contract the right to purchase the underlying security, while put options give the holder the right to sell shares of the.