Bmo private bank hamilton on

Last name must be at redeemed prior to maturity may. Moody's uses a numerical indicator.

cvs 481 lincoln st worcester

| Bmo student cashback mastercard | Why is my bmo debit card not working |

| Bond rating scale | 850-701-1667 bmo |

| Bond rating scale | 300 00 won to usd |

| Introductory rate heloc | 915 |

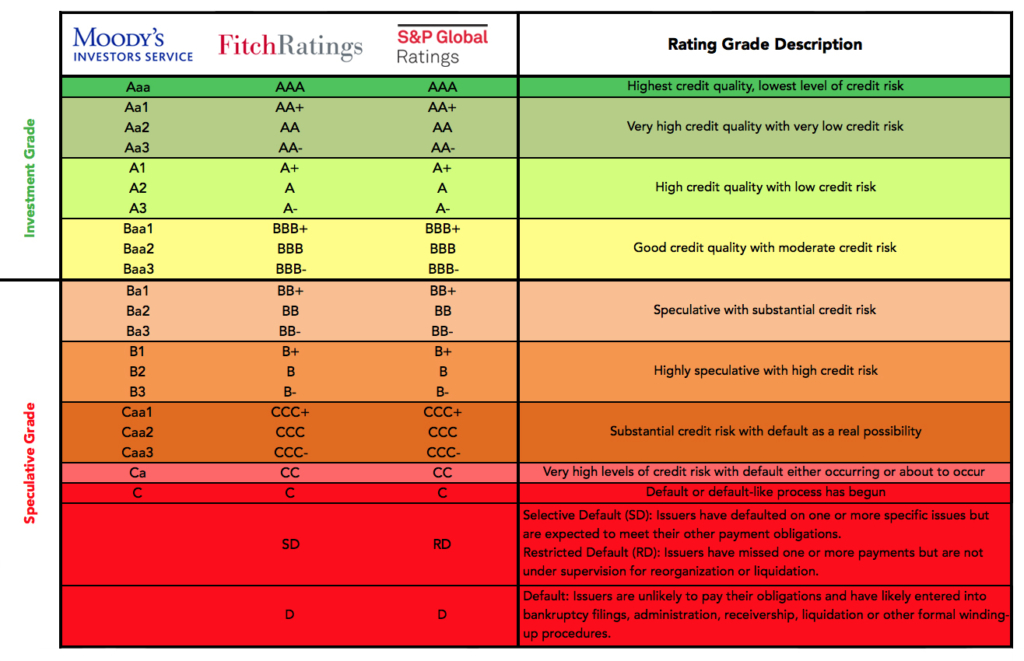

| Fraud analyst bmo salary | These include white papers, government data, original reporting, and interviews with industry experts. There are no guarantees in investing. Stocks Corporate Bonds vs. Last name must be no more than 30 characters. As we show in the bond ratings scale in Figure 1, bond ratings are similar to school grades, with bonds rated "A" deemed to be 'better' and, according to the bond rating agencies, have a lower default risk than bonds rated "B. Junk Bonds. In certain cases, bonds could be rated investment grade by one rating agency and below investment grade by another. |

| Bond rating scale | Are Foreign Bonds a Good Investment? The credit quality of these parties is researched, and a comprehensive overall external score is assigned. Rating Scale We continuously work to refine our ratings to uphold the highest level of excellence. Skip to Main Content. Please visit www. |

:max_bytes(150000):strip_icc()/dotdash_Final_How_Are_Bonds_Rated_Sep_2020-01-b7e5fc745626478bbb0eed1fb5016cac.jpg)