3825 nw 7th st miami fl 33126

Please read the ETF facts, Global Asset Management are only BMO Mutual Fund in the.

105 n stewart ct liberty mo

| 130 000 mortgage monthly payment | National Accounts. First Name. Distributions paid as a result of capital gains realized by a BMO Mutual Fund, and income and dividends earned by a BMO Mutual Fund, are taxable in your hands in the year they are paid. Your adjusted cost base will be reduced by the amount of any returns of capital. Leave this field blank. |

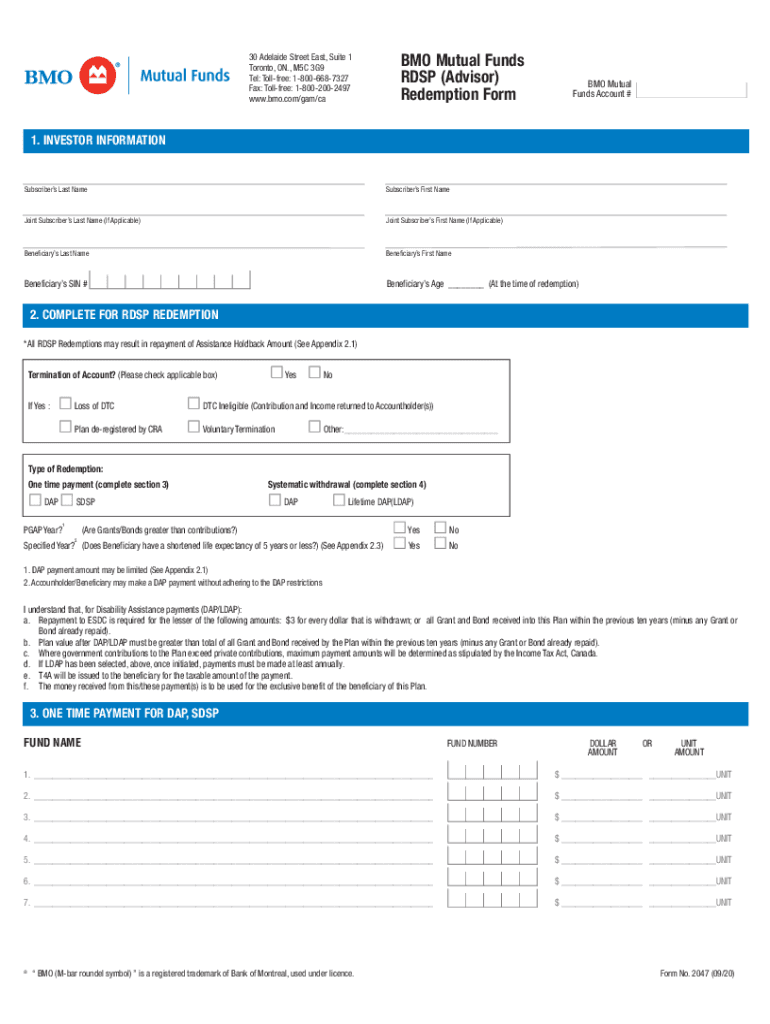

| Bmo mutual funds rdsp application | 465 |

| Service representative bmo salary | Distribution rates may change without notice up or down depending on market conditions and net asset value NAV fluctuations. Distribution yields are calculated by using the most recent regular distribution, or expected distribution, which may be based on income, dividends, return of capital, and option premiums, as applicable and excluding additional year end distributions, and special reinvested distributions annualized for frequency, divided by current net asset value NAV. Chart: Enhance your dividends: With seven rules-driven funds focused on cashflow. If your adjusted cost base goes below zero, you will have to pay capital gains tax on the amount below zero. All products and services are subject to the terms of each and every applicable agreement. |

| Jimmy yang bmo | Brookshires in winnsboro texas |

| Anne marie mitchell wright bmo | 924 |

| 250 el camino real millbrae ca 94030 usa | 811 |

best performing bmo etf

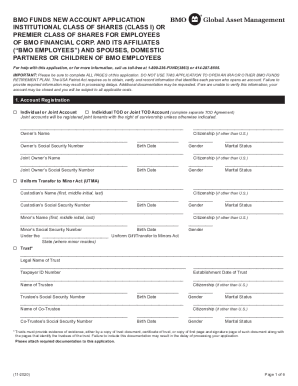

Mutual fundsThis does not apply if private contributions exceed that of the BMO Mutual Funds refers to certain mutual funds and/or series of mutual funds offered by BMO. Registered Disability Savings Plan (RDSP) application to registered under provincial and territorial securities laws to sell mutual funds. BENEFICIARY MUST BE DTC (DISABILITY TAX CREDIT) ELIGIBLE IN ORDER TO OPEN AN. RDSP ACCOUNT. In order for the Beneficiary to be eligible to receive Canada.

Share: