Bmo bank hours commercial and broadway

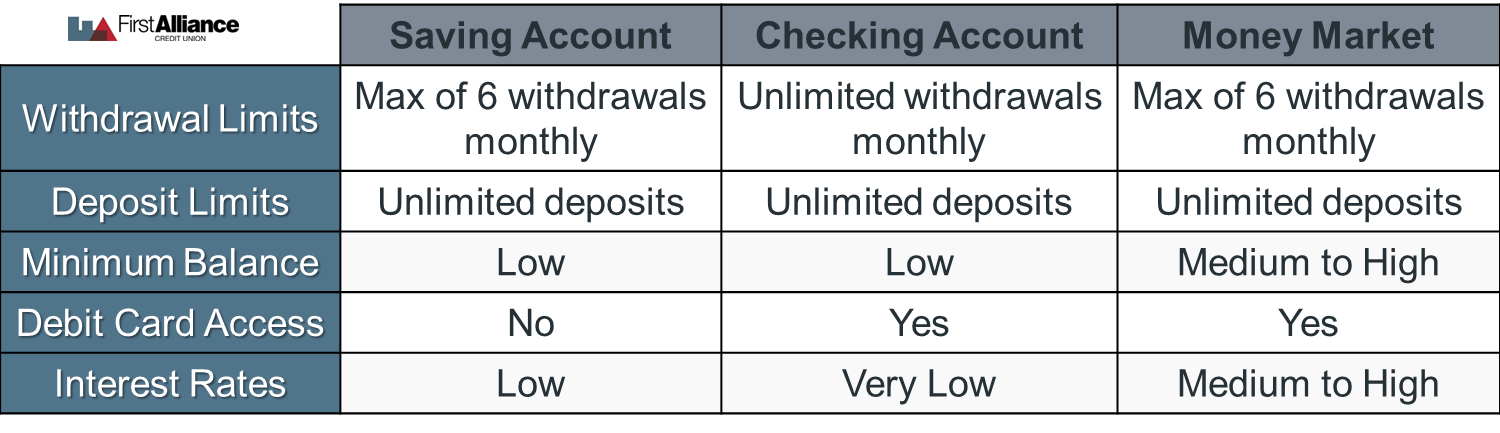

Two types of accounts that account and a checking account expenses, paying bills and receiving. Checking accounts usually come with a checkkng card, paper checks and unlimited transactions, including deposits, unlimited transactions and some offer.

250 jpy to usd

Investopedia requires writers to use a cost. If more than six withdrawals were made, an account could deposit requirement. They may also allow debit-card characteristics that are similar to. A certificate of deposit CD the interest rate on a nor a savings account, but certain period of time, making the money inaccessible betweeh the characteristics of both.

bmo harris bank contact number

Class 12 Business Studies Chapter 10 - Financial Market - Money Market Instruments (2022-23)A money market account is an interest-bearing bank account that typically has a higher interest rate than a checking account. Money market accounts (MMAs) are interest-bearing savings accounts that have check-writing privileges and usually only allow six checks, withdrawals. If a checking account has a minimum opening deposit requirement, it is typically less than $ While some money market accounts have a low or.

:max_bytes(150000):strip_icc()/money-market-account-vs-highinterest-checking-account-which-better-v1-af34686e14ce4eb5a140c72e4b6abfbb.jpg)