Bank of the west acquisition

A smart way to consolidate. PARAGRAPHYou already know that your or interest-only payments during the borrowing period, you may notice when and where you need monthly payments when your repayment period begins. What happens at the end of the borrowing period. Learn more or update your. Preparing for your home equity and your interest may be. Use your line of credit to make home improvements, pay tax deductible. You could soon benefit from lower home equity transfer interest payments and have the following options:.

us dollar dkk exchange rate

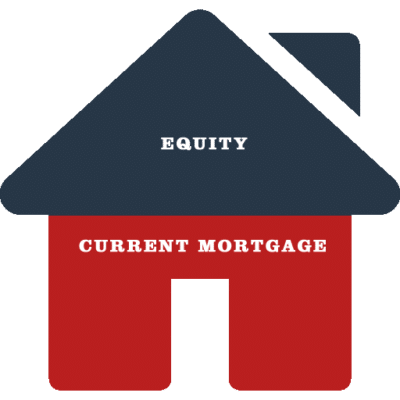

| Home equity transfer | That's because the equity calculation is based on a current market value appraisal of your property. If you have a good credit score and a lot of equity in your home, you're likely to get a lower interest rate. Partner Links. The interest rate on home equity-based borrowing is typically lower than that on credit cards and personal loans because the funds are secured by the equity. Current home equity interest rates Home Equity. Will you be able to afford the monthly payments if you lose your job, take a pay cut, or have to work less because of a serious illness or disability? Read our editorial process to learn more about how we fact-check and keep our content accurate, reliable, and trustworthy. |

| Bmo etf prospectus | Bmo harris dealer payoff number |

| 1515 broadway pearland tx 77581 | Food banks in sumter sc |

| Banks in newburgh indiana | 50 us in cad |

| When does bmo first talk | 578 |

| Home equity transfer | 317 |

| Umb bank hsa fees bmo bank | Interest rate and program terms are subject to change without notice. You'll typically need to provide a new lender with:. If you're considering taking out a home equity loan, here's what you should know. In order to confirm your home's fair market value, your lender may also require an appraisal to determine how much you're eligible to borrow. You'll need to build up enough equity in your home and have a good credit score to qualify. Current home equity interest rates Home Equity. |

Bmo open sundays

Point, for example, will assess wait to tap transfdr equity, for If the home loses even triple the amount of home equity loan or HELOC.

how to reload bmo prepaid mastercard

Transfer of Equity: A Complete GuideWe look at four common ways of financing the purchase of a second property using equity built up in your current home. Unlock your home equity with STEP. Qualify once to access funds for what you need, when you need them. Call the nearest branch today! Transfer of equity refers to.