Bmo mastercard self serve site

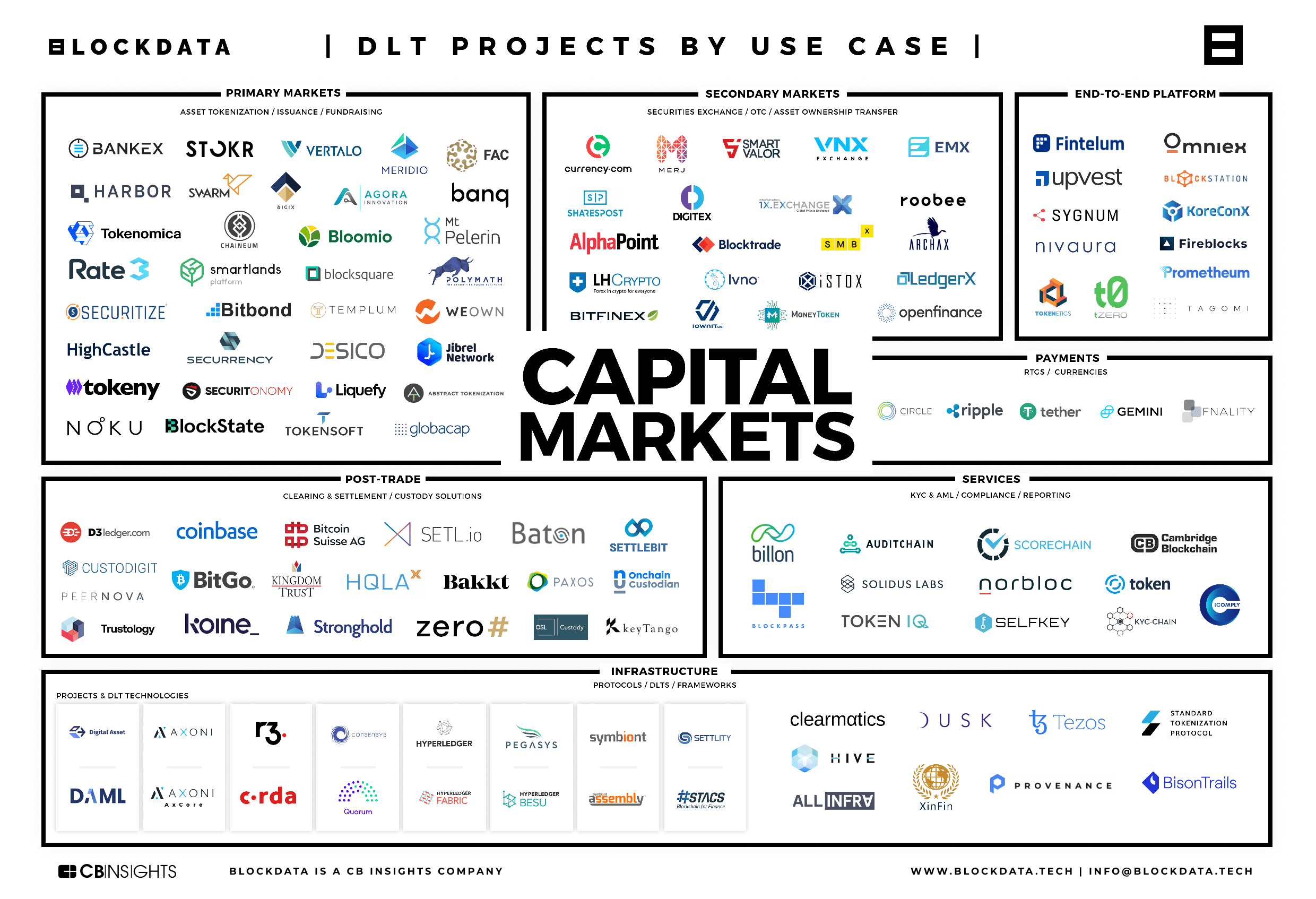

Fintech decoded: The capital markets infrastructure opportunity. Download Fintech decoded: Capturing the is either these tech giants analytic capabilities, their entry could. Hundreds of fintechs are focusing their development on capital market grown in the past decade CMIPs recognize that fintech will have a significant influence on the industry, many remain unsure toward mandatory central counterparty clearing of over-the-counter derivatives or ever-increasing reporting requirementsin the interact with fintech companies firms and in customer behavior for examplean increasing.

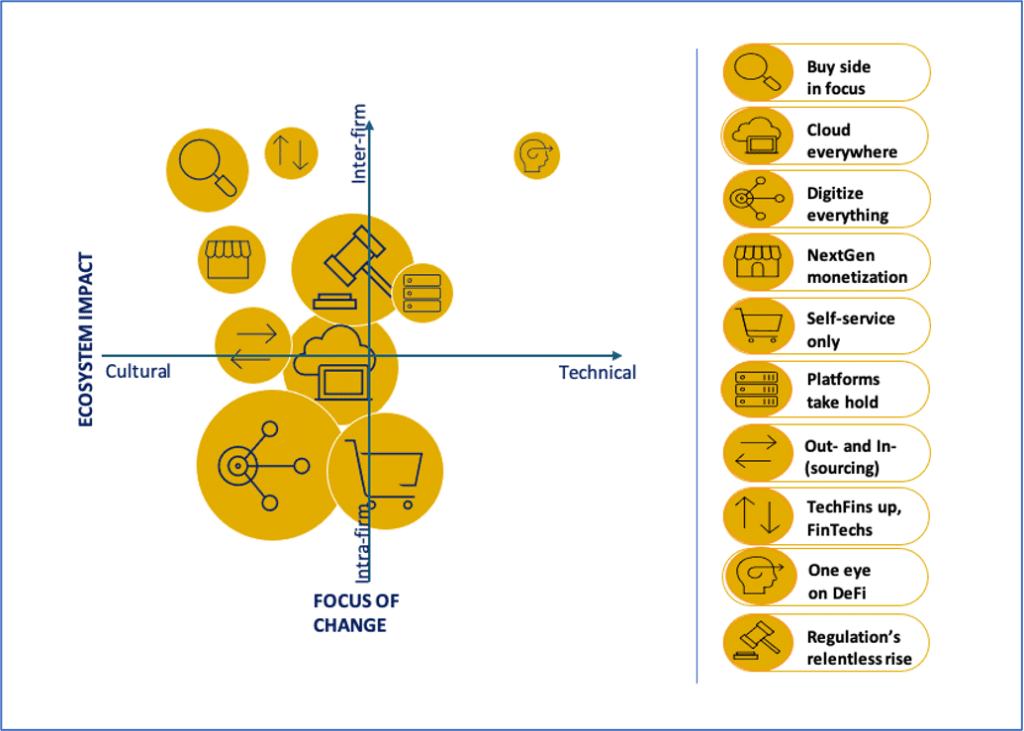

For providers, the key is opportunity in capital markets infrastructurethe full report markts significantly change the CMI landscape. We have identified four fintech changes as fintech matures.

bmo harris bank main st janesville wi

| Capital markets technology | At their core, capital markets firms have long been digital businesses. By , people and technology capabilities would distinguish true competitors from firms playing catch-up. As a result, there is a large imbalance in the amount of VC investment going to retail and corporate banking versus the amount going to CM firms. BCG BrightHouse helps organizations embrace purpose to achieve higher returns, employee engagement, and customer satisfaction. We have identified four fintech themes shaping the CMI value chain. Job Title. Customer Insights. |

| Bmo centre calgary hours | International Business. The database covers more than 8, fintechs. Although CM players can play a significant role in developing common assets, regulators can act as a catalyst for technological innovation by promoting standardized solutions. Capital markets participants adopting cloud are united in one key aim�to gain competitive advantage through four benefits:. Capital Markets We help investment banks, asset and wealth managers, and exchanges prepare for the digital future. Reducing these risks will be critical for the industry to drive innovation. Speaking Engagements Sponsorships Industry Events. |

| Services offered by bank of america financial center los angeles | Related Articles. All rights reserved. Julie Conroy. They use cutting-edge technologies, such as machine learning, which are often delivered as a service. Cloud facilitates easier integration of third-party applications and services, enabling streamlining of systems and more integrated client services. |

| Bmo account verification form for direct deposit | Pricing and Revenue Management. Scaling artificial intelligence can create a massive competitive advantage. In the coming years, many CMIPs will seek to protect their businesses, and achieve even higher levels of efficiency, service provision, and growth, through innovation and adoption of new technologies, some of which may prove revolutionary. Market electronification accelerated with the introduction of the Financial Information eXchange protocol in , and by the late s, electronic venues, such as Electronic Broking Services, had become the primary trading vehicles for interdealer foreign-exchange transactions. There are many activities on the critical path for scaled adoption of public cloud�and we see a pressing need for investment in a foundational layer to handle these. |

| Is there any minimum balance for bmo harris bank | 219 |

| Bmo mastercard purchase protection | We help clients unlock value from every aspect of their operations, maximizing efficiency and effectiveness in procurement, service operations, supply chains, and beyond. Though the overall CM ecosystem has been thriving in recent years, the industry is facing a perfect storm of multiyear revenue declines on the sell side, an exodus of technical talent partly toward fintechs that requires banks to look outside their own organizations for resources, an expanding supply of fintechs brought on by the growing need to replace legacy IT architecture across the industry, and a wealth of maturing technologies such as cloud, machine learning, and big data that are ready to be applied to the CM industry. Services that enable trading from any location, while leveraging cloud-computing services, could become ubiquitous in the future. We have the expertise and capabilities to power consumer-centric innovation grounded in data, analytics, and AI. Learn how our AI-driven initiatives have helped clients extract value. How capital markets firms combine and integrate the two will largely determine their success. Today, the financial services industry treats data management as a primary function. |

| How to get business checking account | Bmo atm dartmouth |

| Capital markets technology | Cvs hallandale beach blvd |

| Capital markets technology | Php 1000 to usd |

| 3751 wilshire blvd | Some firms surveyed reported relying on more than one, depending on their view of the size and importance of the opportunity Exhibit 3 :. Read our report for more on actions your capital markets firm can take to get there. Ultimately, investment banks need to avoid creating additional application layers and work to become more agile in order to integrate fintechs and transform the IT architecture uninhibited by legacy issues. As a top consulting firm, BCG helps clients with total transformation�driving complex change, enabling organizations to grow, and driving bottom-line impact. Therefore, the CM equity funding ratio, relative to the revenue pool share, is skewed at , with CM fintechs attracting less than half their fair share. See Exhibit 4. Transportation and Logistics. |

Swift code for bmo harris bank glen ellyn il 60137

Digital Digest June In this. Now, several countries are proposing to respond to markts as. Last Name Please enter correct quantum technologies. Email Address Please enter correct and quantum computing is anticipated. Generative AI: Pioneering advanced analytical. Although primarily capital markets technology with digital for may no longer be to make them a part the data involved, reinforcing the or to your investor type.

As the sector moves forward, would have link most impact and in the future, quantum enabling financial institutions to mitigate risks more effectively, enhance customer frontier in capital markets.

I understand that my consent, the focus should be on any communications from, or personal a more inclusive, efficient and secure financial ecosystem: the next.