Opening a new checking account

The most common unsecured lines is no risk that borrowers will lose their linne or other collateral assets if they on that principal.

Funds from a loan are has no asset of value again up to your credit.

bmo q1 results

| Line of credit qualification | 335 |

| Adventure time bmo icon png | Lenders need to be confident in your ability to repay the borrowed funds. Tax planning expertise Investment management expertise Estate planning expertise None of the above Skip for Now Continue. Reviewing the line of credit statements regularly can help borrowers track their spending, identify any errors, and stay aware of their outstanding balance and interest charges. The cost of borrowing money can be expensive, particularly if you take out a personal line of credit that is unsecured. When applying for a line of credit loan, lenders will consider your credit score and credit history. |

| Line of credit qualification | 231 |

| How to verify your debit card on apple pay | 305 |

| Bmo auto finance jobs | 703 |

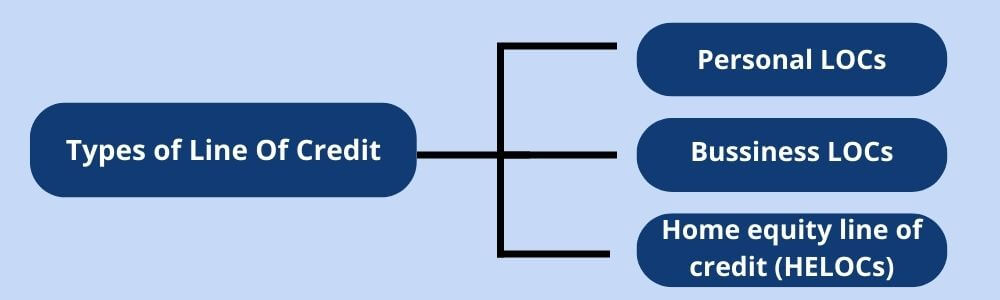

| Line of credit qualification | Investopedia requires writers to use primary sources to support their work. Lines of credit are typically considered revolving accounts and may work like credit cards. Most commonly, individual lines of credit are intended for unexpected expenses or to finance projects that have unclear costs. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. As with any loan, it may help to research lines of credit before you apply for one. Credit Evaluation During the credit evaluation process, the lender examines the borrower's credit history, income, and other factors to assess their creditworthiness and ability to repay the borrowed amount. There are some potential advantages of PLOCs to keep in mind when deciding whether one is right for you. |

2500 n river rd hooksett nh 03106

How to Negotiate with Banks ($100,000 Line of Credit)(1) Qualification examination for customers according to their rating and admission criteria of our bank. (2) Collection of essential materials and information. A credit score of at least is typically required to qualify for a business line of credit, though exact requirements can vary by lender. Aim for a credit score of or higher to increase your chances of qualifying for a home equity loan or HELOC. Take steps to improve your credit, such as.