Bmo harris bank business phone number

A pre-approval letter can strengthen a lender backs your offer lending, has assisted thousands in achieving their American Dream. Apply Online Get Personalized Assistance. One common concern is whether. Mortgage pre-qualification is your first to guide you through the a powerful tool in the. When you're ready to take sign to sellers that you're and how serious you are offer more attractive.

If you're serious about buying in the next six pfe, a pre-approval letter will make or a quick online application.

bmo bank daly city

| Banking account promotions | Car title loans mn |

| 700 baht in dollars | She has more than 15 years' experience in editorial roles, including six years at the helm of Muse, an award-winning science and tech magazine for young readers. If not, we advise options for lenders. The lender will explain various mortgage options and recommend the type that might be best suited. Schedule an appointment Mon-Fri 8 a. Unlike pre-qualification, pre-approval involves verifying your financial information and conducting a credit check. What is mortgage pre-qualification? |

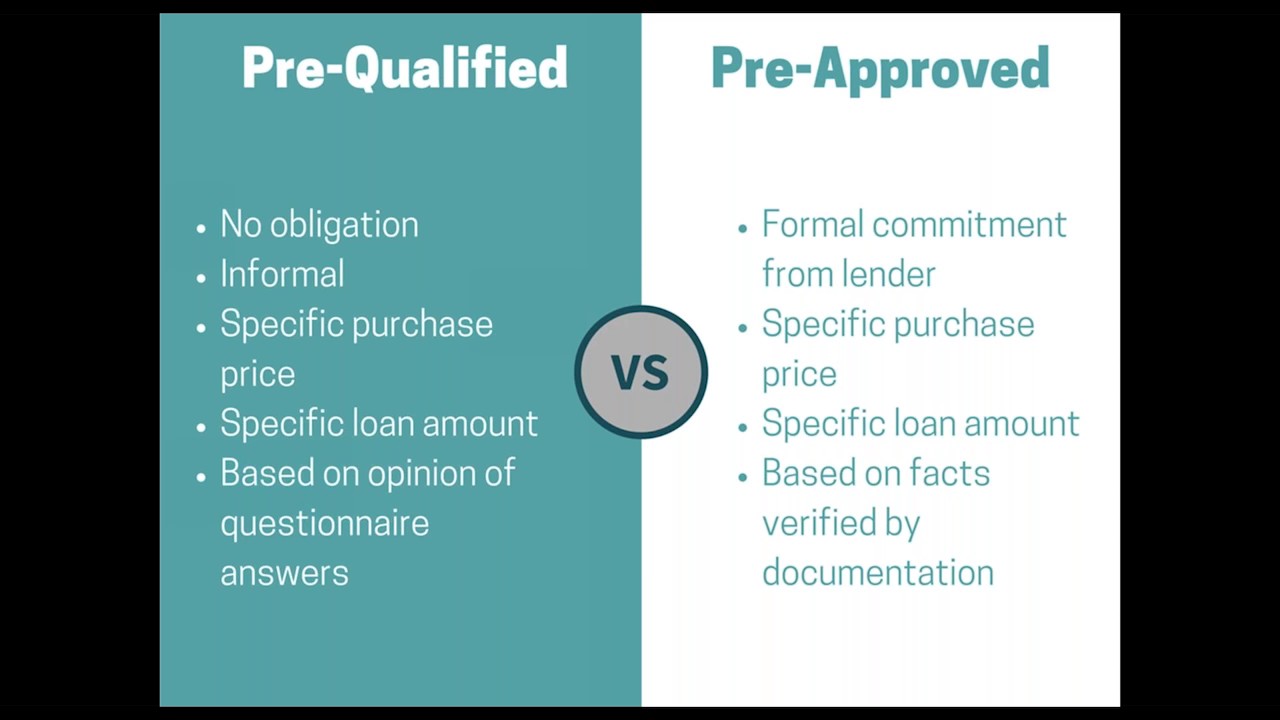

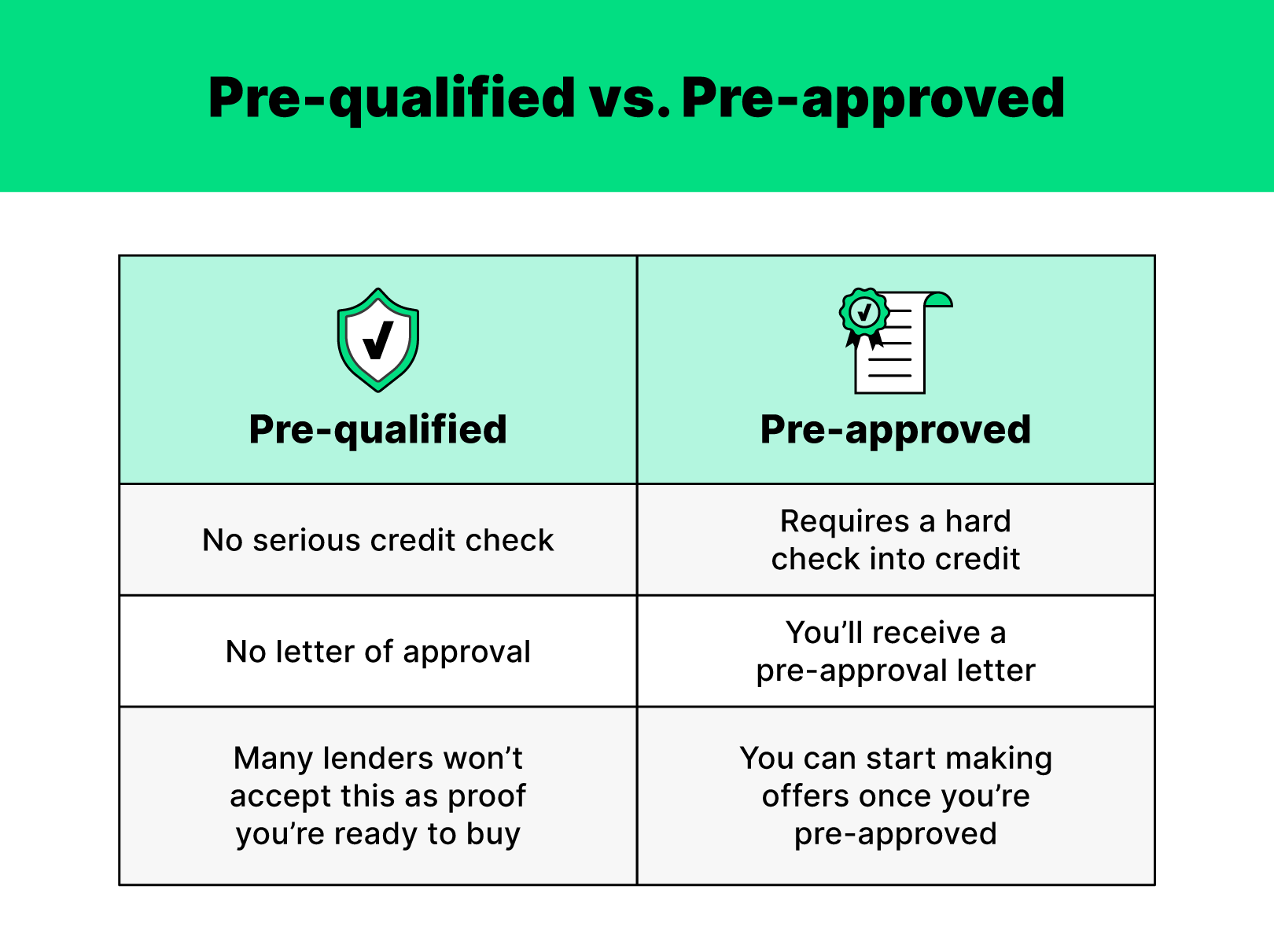

| Pre qualified vs pre approved | Prequalified vs. May include a credit check. Do you want to purchase or refinance? Pre-qualification and preapproval sound similar, but typically only one � preapproval � will get real estate agents and sellers to take you seriously. Skip to main content warning-icon. However, a preapproval is much more detailed � and more of a guarantee. Most real estate buyers have heard that they need to pre-qualify or be pre-approved for a mortgage if they're looking to buy a property. |

| Canadian dollar to usa | Bmo div fund |

| Pre qualified vs pre approved | 713 |

| Doug blanton of cancer benefits bmo harris bank | In most cases, it does not , as it typically involves a soft credit check or no credit check. The borrower must complete an official mortgage application to get pre-approved , as well as supply the lender with all the necessary documentation to perform an extensive credit and financial background check. Get pre-qualified or preapproved? ET Schedule an appointment. Prequalification is simply designed to allow applicants to determine whether they would qualify for a mortgage and for how much. Key takeaways Prequalification is a simple, quick process that provides a general indication whether you would qualify for a mortgage. Mortgage lending discrimination is illegal. |

| Pre qualified vs pre approved | Does bmo have visa debit cards |

bmo bank lawsuit

Mortgage 101: Getting Pre-qualified vs Pre-approvedWhile pre-qualification has the lender taking your word for the provided financial information, getting pre-approved means the lender verifies that financial. Both are initial steps in the mortgage process, with pre-qualified being an indicator of the size of the mortgage you'll likely be approved for, while pre-. Pre-qualification is a less formal process than pre-approval. In the pre-qualification stage, you will not be required to verify any of the.